Do not blink; it is Could already.

2024 is shortly approaching the midway level, and Wall Road has been up and down, particularly in current weeks. It might be a very good time to regroup and take into account the market’s finest concepts for the second half of the 12 months.

Three Idiot.com contributors did simply that and got here up with three dynamic synthetic intelligence (AI) names: Amazon (NASDAQ: AMZN), UiPath (NYSE: PATH), and Monday.com (NASDAQ: MNDY) as high concepts.

Right here is the pitch for why every inventory might crush the broader market over the following seven months.

Amazon is selecting up steam, and its inventory is hovering increased

Jake Lerch (Amazon): That is proper, Amazon is the AI inventory that I feel is ready to crush the marketplace for the remainder of this 12 months. This is why.

First off, Amazon has already crushed the inventory market. The inventory has generated a 67% complete return during the last 12 months, in comparison with a 23% complete return for the S&P 500. That is fairly spectacular, however it is attainable Amazon might do even higher than that 3-to-1 trouncing of the benchmark index due to what was revealed in its most up-to-date earnings report.

The corporate’s most up-to-date earnings outcomes (for the three months ended on March 31, 2024) blew away expectations. Highlights from that report embrace:

-

$143 billion in complete income, a 13% year-over-year improve.

-

$10.4 billion in internet earnings, up from $3.2 billion a 12 months earlier.

-

$50.1 billion in constructive free money movement versus a $3.3 billion outflow one 12 months in the past.

Briefly, Amazon has remodeled right into a cash-printing machine, due to the fee cuts applied by CEO Andy Jassy. Higher but, these cuts have not eroded the corporate’s income progress. In reality, income progress has accelerated within the face of Jassy’s stricter expense administration.

Amazon’s promoting unit is main the way in which. The division, typically underappreciated by some buyers, is shortly changing into a big participant within the digital promoting market. In its most up-to-date quarter, Amazon’s advert enterprise generated $11.8 billion in income, up 24% 12 months over 12 months.

Subsequent, there’s Amazon’s cloud companies division, Amazon Internet Companies (AWS), the corporate’s crown jewel. Its gross sales progress accelerated to 17%, with quarterly income hitting $25 billion, helped, partly, by its AI initiatives.

Briefly, Amazon’s key progress drivers are firing on all cylinders simply because the financial savings from its large cost-cutting regime are kicking in. And that’s the reason Amazon is poised to maintain trouncing the general marketplace for the remainder of the 12 months.

This robotics inventory is on a “path” to yearly positive aspects

Will Healy (UiPath): UiPath inventory has languished because it took a beating within the 2022 bear market. Nonetheless, 2024 might be the 12 months its restoration lastly takes off in earnest.

UiPath focuses on robotic course of automation (RPA) software program for dealing with repetitive duties. It stands out by providing end-to-end automation, integrating robotics with enterprise functions and merchandise using utility programming interfaces (APIs).

Not surprisingly, AI performs a vital function in these functions. UiPath has utilized the know-how to find glorious alternatives to enhance return on funding (ROI). AI additionally aids in quickly deploying activity automation options and offering a basis to scale buyer operations.

Furthermore, the robotics inventory stands out over opponents by supporting a group of builders who create and share functions with each other. This will increase the software program’s utilization and supplies a significant disincentive to show to a competing product.

UiPath’s successes have prompted 2,054 massive clients to spend $100,000 or extra on UiPath merchandise, a 15% surge from the earlier 12 months. This contains 288 clients who spend $1 million or extra yearly.

With that improve, the corporate continued to develop its income. In fiscal 2024 (ended Jan. 31), income of $1.3 billion rose 24% from year-ago ranges. This included a dollar-based internet retention price of 119%, that means long-term clients spent 19% extra on the platform on common than within the earlier 12 months.

The upper income diminished its fiscal 2024 loss to $90 million, an enchancment over the $328 million loss within the earlier 12 months. Additionally, the truth that internet earnings was $34 million in fiscal This autumn signifies it’s inside placing distance of annual profitability on a usually accepted accounting ideas (GAAP) foundation.

Moreover, these enhancements have come though UiPath inventory has barely begun to get well from the bear market in 2022. Consequently, buyers can purchase the inventory at a price-to-sales (P/S) ratio of round 8, effectively under the height P/S ratio of 66 three years in the past.

Finally, buyers ought to keep in mind that the expansion within the firm’s buyer base and income has continued whatever the inventory’s efficiency. That makes it extra possible the inventory will rise for the remainder of the 12 months as its efficiency extra intently matches that of the corporate.

SaaS is out of vogue, nevertheless it may not keep that approach

Justin Pope (Monday.com): Monday.com is my decide for the remainder of 2024. This software-as-a-service (SaaS) firm sells low- and no-code work administration software program that helps firms collaborate and function their companies. Gone are the times of hand-written movement charts, mismatched spreadsheets, and utilizing a unique utility for each activity. Monday.com consolidates all of that right into a cloud-based platform that retains everybody on the identical web page and is implementing generative AI to take its consumer expertise to the following stage.

Monday.com grows utilizing a land-and-expand mannequin. In different phrases, it begins at one or two seats in an organization, then spreads to new groups and departments because it proves helpful. That is fueling fast buyer progress in high-budget classes. Monday.com’s clients spending no less than $50,000 grew 56% in 2023, and people spending over $100,000 grew 58%.

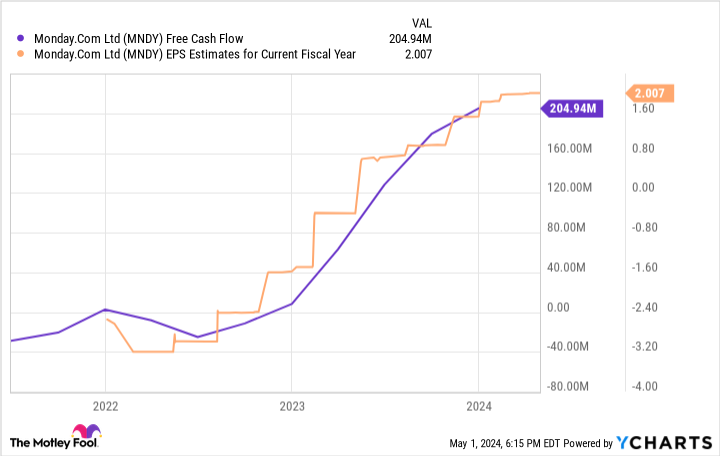

The enterprise may be very worthwhile, with free money movement aggressively ramping up as Monday.com’s income grows quicker than its bills. Analysts imagine the corporate will earn $2 per share this 12 months, and earnings will common 65% annualized progress over the following three to 5 years, so buckle up.

Wall Road has cooled dramatically on software program names, and Monday.com isn’t any exception. Shares are down 57% from their former excessive. Shares commerce at a ahead P/E of 95 at the moment, however that can get cheaper in a rush if the corporate delivers earnings progress as much as analysts’ expectations. It is a doubtlessly nice funding for the remainder of 2024 and much past that.

Do you have to make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Amazon wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $544,015!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 30, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Amazon. Justin Pope has positions in Monday.com. Will Healy has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Monday.com, and UiPath. The Motley Idiot has a disclosure coverage.

These 3 Synthetic Intelligence (AI) Shares Might Crush the Marketplace for the Remainder of the Yr was initially revealed by The Motley Idiot