Initially printed on Unchained.com.

Unchained is the official US Collaborative Custody companion of Bitcoin Journal and an integral sponsor of associated written content material launched through Bitcoin Journal. For a lot extra info and details on suppliers obtainable, custody merchandise, and the partnership involving Unchained and Bitcoin Journal, you should definitely try our website online.

For newcomers, particularly people in and throughout retirement age, the considered investing in or possessing bitcoin can evoke reactions from skepticism to disbelief. In case you seem past the frequent narratives, even so, you might presumably uncover there’s further to the story than very first impressions counsel. Beneath are 6 motives to consider possessing at minimal some bitcoin all through retirement.

1. Bitcoin will assist broaden your asset allocation basis

Ordinarily, buyers use a way known as asset allocation to distribute and defend assets from monetary funding chance above time. A appear asset allocation tactic is the antidote to inserting all your eggs in a single basket. There are fairly a couple of types of asset “lessons” or teams about which to distribute threat. Usually, advisors discover to construct a dynamic mix in between monetary debt devices (i.e., bonds), equities (i.e., shares), actual property, cash, and commodities.

The rather more sorts you rent to distribute your property and the so much much less correlated people classes are, the improved your prospects of balancing your probability, on the very least theoretically. These days, on account of unintended results introduced on by the extreme development of societal bank card debt and the funds provide, property which were earlier fewer correlated now generally tend to behave rather more in selection with only one one other. When an individual sector receives hammered proper now, many sectors usually undergo collectively.

Regardless of of those present-working day issues, asset allocation continues to be a well-conceived strategy for moderating threat. Whereas proceed to in its relative infancy, bitcoin represents a completely new asset class. Given that of this, proudly proudly owning at minimal some bitcoin, particularly owing to its distinct properties when in comparison with different “cryptocurrencies,” offers a chance to broaden your asset base and further correctly distribute your common chance.

2. Bitcoin gives a hedge versus inflation and forex debasement

As a retiree, safeguarding oneself from inflation is significant to preserving your extended-time interval buying electrical energy. Within the asset allocation dialogue earlier talked about, we referenced the newest and intense {dollars} provide growth. Everybody who has lived very lengthy ample to method retirement age appreciates {that a} dollar no for an extended time buys what it utilised to. When the governing administration challenges substantial quantities of latest money, it debases the price of the bucks already in circulation. This continuously pushes costs elevated as lately created kilos begin out to chase the prevailing constrained present of things and suppliers.

Our personal Parker Lewis touched on this extensively in his Steadily, Then Rapidly sequence:

In abstract, when hoping to understand bitcoin as income, begin off with gold, the dollar, the Fed, quantitative easing and why bitcoin’s provide is fixed. Funds isn’t just a collective hallucination or a perception course of there’s rhyme and clarification. Bitcoin exists as an answer to the {dollars} problem that’s worldwide QE and when you imagine that the deterioration of close by currencies in Turkey, Argentina or Venezuela may rarely occur to the U.S. greenback or to a produced financial local weather, we’re merely at a novel place on the same curve.

In distinction to fiat currencies, no a single can enhance the provide and arbitrarily decrease bitcoin’s worth. There aren’t any centralized authorities that govern its monetary plan. Regardless of arguments on the contrary, bitcoin is similar to gold—however not exactly, because of the truth gold miners stick with it to inflate the provide of gold nearly each 12 months at a degree of 1-2%.

As bitcoin is steadily launched to the circulating provide (i.e., mined), its inflation payment decreases and can sooner or later stop. This actuality makes bitcoin uniquely scarce amid worldwide monetary property. In the long term, this scarcity, alongside with bitcoin’s different financial homes, ought to actually safeguard its getting electrical energy. As this sort of, possessing bitcoin via retirement offers you a hedge in opposition to inflation.

3. Bitcoin affords an possibility for uneven returns

Bitcoin’s potential to mitigate most of the worries we discuss on this article rests on its talent to succeed in uneven returns. Its provide is preset (there’ll solely at any time be 21,000,000 bitcoin), and wish for the asset is rising steadily. As this restricted supply collides with amplified retail store-of-benefit adoption from individuals, institutions, and governments, bitcoin has the chance to dwarf the returns of virtually each single competing asset class.

It’s actually value noting that women and men normally strengthen their returns with bitcoin once they keep it for the extended time period. Within the current day period, retirements lasting a few years or rather more are an increasing number of prevalent. Above these time intervals, even a minimal allocation to bitcoin offers ample chance to revenue from its upside potential. You simply will want time to carry by way of the short-term volatility, which opposite to well-known notion, just isn’t proof of it staying a poor store of profit.

Sequestering a portion of cash just for appreciation all via retirement operates reasonably counter to frequent information. Modern retirement getting ready usually optimizes for the liquidation of portfolio money to supply money stream. Even so, inserting aside a compact quantity of bitcoin—stored steadfastly gated from money earmarked for revenue—opens the door to revenue from the monetization of bitcoin’s constrained supply.

4. Bitcoin delivers safety from the opportunity of prolonged-term bonds

Conventionally, high-quality bonds—held straight or as fund shares—make up a considerable part of most retirement portfolios due to their small probability levels and inclination towards money preservation. Then again, issues have modified.

Monetary development and improves in societal private debt have compelled bond yields—or the sum of fascination paid (i.e., coupon)—to historically very low levels. The yields on most bonds at the moment drop very effectively beneath the speed of inflation. This “adverse precise yield” normally signifies that proudly proudly owning a bond can price ticket you {dollars}. However the issue doesn’t finish there.

Since retirees want cash from their portfolios to pay again expenditures, they usually should present property at latest market premiums to derive income all through retirement. Within the situation of bonds, at present, this may be fairly problematic. Consider the adhering to equations.

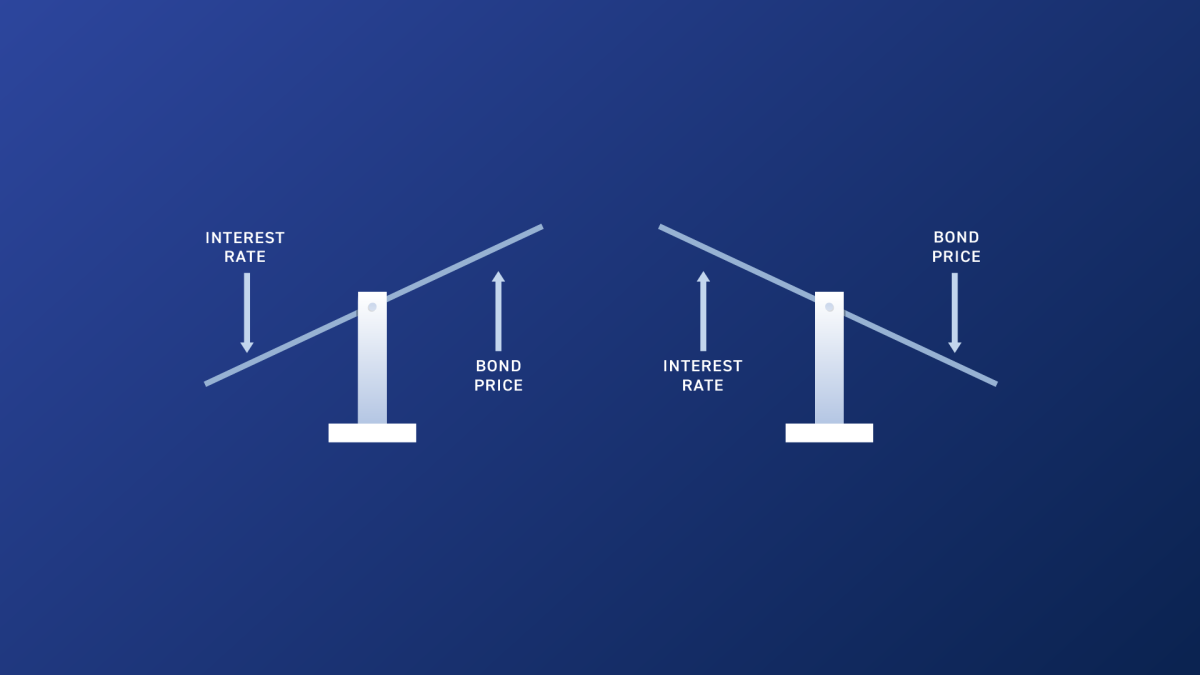

- How so much {dollars} does it select for a bond paying a 2% fee to generate $20? Reply: $1,000. ($1,000 x 2% = $20)

- How so much money does it take for a bond paying a 4% payment to generate $20? Resolution: $500. ($500 x 4% = $20)

These two equations expose that to provide the equivalent $20 return, the market place worth of the basic bond modifications based mostly on the curiosity degree promised.

- When want charges go up, the present market advantage of bonds goes down.

- When curiosity costs go down, the trade value of bonds goes up.

{The marketplace} worth of bonds has an inverse connection to fascination charges. Ponder that rates of interest proper now hover in shut proximity to historic lows. In extra of the next 20 to thirty yrs, what is going to occur to the market value of bonds held by retirees if fascination charges enhance considerably? The reply to: the sector advantage of their bonds will collapse.

This modifications the general risk paradigm for bonds in retirement portfolios and maybe would make them significantly so much much less risk-free than generally imagined. Bitcoin exists in a impartial asset class from bonds it’s a bearer instrument that isn’t uncovered to the same cash market challenges. As these sorts of, possessing bitcoin might maybe help you offset at minimal a few of the potential probability incurred from possessing bonds in retirement.

5. Bitcoin incorporates a potential treatment for very long-time interval healthcare probability

One other spot of concern for retirees is the price of well being care. Listed right here, I’m not referring a lot to frequent well being care prices however alternatively to the attainable to incur lengthy-time interval remedy charges in in a while age. Insurance coverage coverage is accessible for prolonged-phrase care, however it has some distinctive and an increasing number of powerful troubles to overcome.

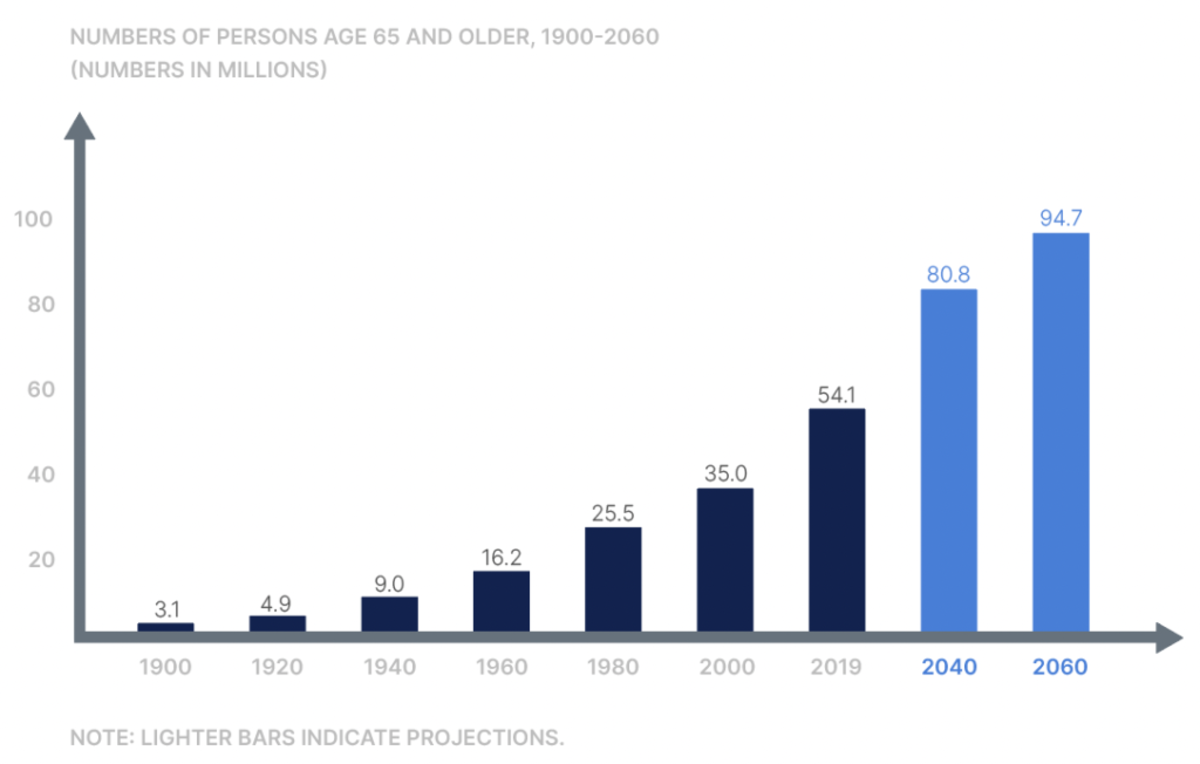

Well being care, on the whole, requires a double-strike when it’s going to come to cost inflation. Not solely do well being care costs enhance due to to financial debasement, however well being care faces added headwinds from demand from clients spurred by development within the getting previous populace.

States management insurance coverage plan for long-time interval remedy. To carry policyowners safe, insurers cope with scrutiny about the place and the way they commit protection charges. To take care of cash wanted for potential claims, insurers usually rely upon very low-threat, intermediate and extended-time interval bonds. Nonetheless, as our dialogue over on bonds reveals, minimal yields and the possible for hovering charges complicate this observe. One explicit quick fallout is that charges for very long-time interval care insurance coverage insurance policies insurance policies have risen significantly.

We famous earlier bitcoin’s usefulness as an inflation hedge and its attainable for extended-expression price ticket appreciation. Because it pertains to extended-term healthcare, it could maybe make sense to set aside some bitcoin explicitly centered as a hedge for this shortly growing worth.

6. Bitcoin delivers you private sovereignty

The remaining trigger we’ll take note of for proudly owning bitcoin in retirement is that it delivers you amplified particular person sovereignty. Bitcoin gives you a stage of possession that isn’t achievable with different property. It might probably simply be carried throughout borders with a elements pockets or seed phrase, for illustration, or transferred peer-to-peer any the place within the surroundings at small price.

In case you maintain bitcoin securely in a pockets you handle, no central financial institution can steal the worth of your bitcoin by printing it into oblivion. No CEO can dilute its worth by issuing much more of its “shares.” Nor can a financial institution arbitrarily block entry to or confiscate your cash. In contrast with centralized fiscal custodians, which could be bought to freeze or withhold assets on the whims of authorities or different Third-get collectively authorities, bitcoin with keys completely held is resistant to those forms of overreach.

Specifically for retirement functions, it’s also possible to keep your private keys for bitcoin in an IRA. Merchandise just like the Unchained IRA are a sturdy instrument for constructing and conserving your prosperity on a tax-advantaged basis. And maintaining your bitcoin keys within the sort of a multisig collaborative custody vault will help you take away all solitary factors of failure while you achieve this.

Appear monetary concepts and possessing bitcoin

Benefitting from bitcoin doesn’t want committing to wild hypothesis or inconsiderate abandonment of audio financial guidelines. In distinction, the much more you glimpse at bitcoin by way of audio cash ideas and implement them to your contemplating, the larger the prospects it presents. One steadfast monetary precept that coincides with bitcoin possession is prudence.

Macro-economic funding determination strategist Lyn Alden usually speaks of making a “non-zero place” in bitcoin (i.e., proudly owning no less than some). The hazard of dropping a handful of portfolio proportion factors in a worst-situation situation is, in my estimation, effectively well worth the potential upside. However to be clear, every individual’s circumstance is distinctive. You need to do your have examine and make the very best choices you possibly can about what capabilities in your distinct situation.

Initially posted on Unchained.com.

Unchained is the official US Collaborative Custody husband or spouse of Bitcoin Journal and an integral sponsor of related content material materials posted on account of Bitcoin Journal. For additional information on skilled providers supplied, custody merchandise, and the romance regarding Unchained and Bitcoin Journal, it’s best to try our web web site.

Browse more on bitcoinmagazine

/cdn.vox-cdn.com/uploads/chorus_asset/file/22658744/VRG05AH_210614_4634_006.jpg)