Synthetic intelligence market is a really broad subject, it refers back to the synthetic intelligence expertise as the principle, by the idea steerage and software integration of the sector. Normal steerage is generally composed of info info and calculation means steerage, which provides fundamental options for the event of synthetic intelligence expertise and its market Integration particularly refers to many subsectors like clever finance, and robotics. From the economic stage, the factitious intelligence market: one is {the marketplace} with synthetic intelligence know-how because the core. Such industries instantly current services and products by way of synthetic intelligence know-how alone, effectively strengthening the efficiency of business features. The opposite is the factitious intelligence expertise integration sector. This number of subject is generally by the use of the trendy integration of synthetic intelligence expertise and conventional industries, in order to reinforce customary industries and selection new clever industries. These two varieties of synthetic intelligence industries are centered on synthetic intelligence know-how as the principle ingredient of development, with clever agglomeration, details-driven, info sharing and different traits.

Artificial intelligence enterprise index selection and data sources

The data utilized on this paper is primarily sourced from quite a lot of Chinese language statistical yearbooks masking the time interval from 2008 to 2022, which embrace the China Statistical Yearbook, China Vital-tech Enterprise Statistical Yearbook, China Science and Expertise Statistical Yearbook, and China Digital Data Area Statistical Yearbook.

Synthetic intelligence sector index measurement

Although the number of artificial intelligence enterprise index growth considers the advance of synthetic intelligence trade from distinct components, there’s nonetheless a correlation between many indicators. For that purpose, in get to even additional decrease the correlation regarding indicators, this paper adopts the worldwide principal part evaluation methodology to include these 15 indicators right into a complete index, specifically, synthetic intelligence trade index. On this paper, the SPSS22 econometric and statistical software program is utilised to carry out principal ingredient analysis on the AI market development indicators of 30 provincial cities in China from 2008 to 2022, after which the AI market development index is manufactured.

The check out outcomes of this paper exhibit (Desk 1) that the appropriate measure worth of KMO sampling is .72, greater than .6, which satisfies the prerequisite of principal half evaluation, indicating that the artificial intelligence trade index particulars is appropriate for principal component investigation (p < 0.05). Decide the principal part components. In response to the theoretical expertise of principal part evaluation, it's extra applicable for the part with eigenvalue better than 1 to be the principal part. When the eigenvalue is larger than 1, solely the primary two parts can be found, and the cumulative variance contribution fee is 82.03%, indicating that these two parts can absolutely replicate the data of the unique knowledge. Due to this fact, we extract these two parts as the principle parts and file them as F1 and F2 respectively.

Regression estimation methodology was used to calculate the issue rating coefficient and the burden of every index, see Desk 2.

Decide the factitious intelligence trade index. In response to the outcomes of principal part evaluation, the event index of synthetic intelligence trade is set. Synthetic intelligence trade (AI) is used to signify the factitious intelligence trade, and the factitious intelligence trade index is expressed as14:

$$ {textual content{AI}} = 0.1301{textual content{S}}1 + 0.2344{textual content{S}}2 + 0.0985{textual content{S}}3…… + 0.1960{textual content{S}}7 $$

(1)

In response to earlier analysis, the event stage of synthetic intelligence trade in every province is standardized:

$$AI=frac{Fi}{maxFi-minFi}$$

(2)

the place Fi is the excellent issue rating of i province. The maxFi and min Fi are the utmost and minimal values of complete issue scores similar to province i.

Calculation outcomes and evaluation of synthetic intelligence trade indicators

From the attitude of the general change traits: from 2008 to 2017, with the excellent optimization of China’s synthetic intelligence trade growth coverage, the regular enchancment of innovation capability, the continual consolidation of the economic basis, the continual enchancment of the event setting, and the continual deepening of integration and software, the event of synthetic intelligence trade in 30 provinces in China confirmed a great development of rising yr by yr. That is the results of the state’s sturdy help for the development of clever industries, steady promotion of synthetic intelligence expertise innovation and progress, and the fast growth of synthetic intelligence trade in the entire society. Our analysis exhibits the factitious intelligence trade growth index and its common nationwide synthetic intelligence trade throughout 2008–2017, and Fig. 1 exhibits the general development of the typical nationwide synthetic intelligence trade growth stage throughout 2008–2017. China’s synthetic intelligence trade growth index is 0.481, which is greater than the nationwide common stage of synthetic intelligence trade growth in 15 provinces, of which Beijing (1.033), Shanghai (0.946), Jiangsu (0.876), Guangdong (0.867) and Zhejiang (0.830) are ranked within the prime 5 in China’s synthetic intelligence trade growth. Shanxi (0.189), Gansu (0.160), Xinjiang (0.159), Hainan (0.061), and Qinghai (0.052) are ranked within the backside 5 of China, amongst which Hainan is split into the japanese area, however its financial growth and scientific analysis stage are nonetheless a sure hole with different japanese areas, so the event stage of synthetic intelligence trade is low. This exhibits that the event development of China’s synthetic intelligence trade is just like that of financial growth, and likewise exhibits a lowering development yr by yr from the southeast coast to the northwest inland.

Nationwide common synthetic intelligence trade growth stage from 2008 to 2017.

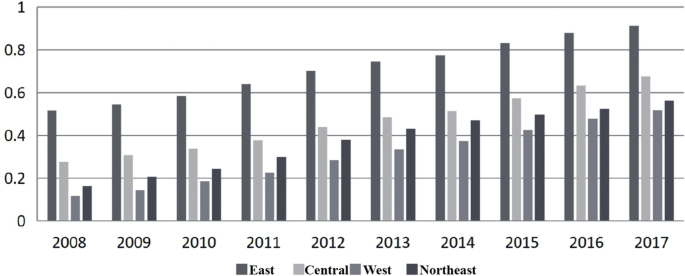

From the attitude of regional fluctuation traits (as proven in Fig. 2): 1. The common growth index of business intelligence trade is 0.713, exceeding the nationwide common stage of 0.232, and is in an absolute main place. Within the japanese area, Beijing and Shandong, counting on the development of sensible metropolis clusters across the Bohai Sea financial Circle, have core aggressive benefits in clever expertise analysis and growth and clever trade cultivation. Revised: Leveraging the manufacturing hub of the Yangtze River Delta Financial Belt, Shanghai, Jiangsu and Zhejiang have actively superior clever manufacturing applied sciences such because the Web of Issues and cloud computing, driving widespread growth of the factitious intelligence trade throughout numerous social and financial sectors. Constructing on the aggressive fringe of the Pearl River Delta Financial Circle and the Guangdong-Hong Kong-Macao Higher Bay Space, Guangdong will additional improve its strategic format and development within the synthetic intelligence trade to realize modern growth on this subject. 2. Balanced growth of the central area. The common growth index of synthetic intelligence trade within the central area is 0.462, and the event is balanced throughout the area. Amongst them, the event stage of synthetic intelligence trade in Anhui (0.587), Henan (0.523) and Hubei (0.563) is comparatively shut, and is in the next place within the central area. 3 Polarization within the western area. The common index of synthetic intelligence trade growth within the western area is 0.309, lagging behind the nationwide common stage of 0.172, and the event within the area is considerably polarized. The mixture of insurance policies and industries in Sichuan and Chongqing has successfully promoted the fast growth of the factitious intelligence trade, and the factitious intelligence trade index ranks ninth and sixteenth within the nation respectively. Shaanxi and Guizhou have excellent benefits in science and expertise analysis and growth and massive knowledge software, accelerating synthetic intelligence and industrial growth. The event stage of synthetic intelligence trade in different western areas is comparatively backward. 4. The extent of northeast China shouldn’t be excessive. The common growth index of synthetic intelligence trade in Northeast China is 0.378, greater than the extent of western areas, however nonetheless decrease than the nationwide growth stage of 0.103. Amongst them, Liaoning’s synthetic intelligence trade growth index of 0.554 is greater than the nationwide common, rating first in Northeast China. The general stage of growth of synthetic intelligence trade in Northeast China shouldn’t be excessive, which can be associated to components reminiscent of inadequate inside impetus for financial growth in Northeast China, problem in changing previous and new financial momentum, small scale of growth of synthetic intelligence trade, and inadequate funding.

Change development of sub-regional synthetic intelligence trade growth index (From left to proper, East, central, West, Northeast of China).

This paper analyzes the impression of the factitious intelligence trade on high-quality financial growth by incorporating the factitious intelligence trade growth index into the framework of research. With a view to account for the dynamic nature of high-quality financial growth, we additionally embrace a first-order lag variable of the defined variable in our evaluation.

$$ HQD_{it} = B_{0} + B_{1} HQD_{it – 1} + B_{2} AI_{it} + B_{3} X_{it} + E_{it} $$

(3)

Within the above system, t and that i respectively signify completely different years and provinces HQDit = the high-quality financial growth index of the i province within the t yr HQDit-1 = the high-quality financial growth index of the i province within the one interval lagging behind AIit = the factitious intelligence trade growth index of the i province within the t yr Xit = the management variable of the i province within the t yr. B0 represents the intercept time period, Eit = the random error time period. B1,2,3 = parameter to be estimated, B2 = the affect coefficient of synthetic intelligence trade on high-quality financial progress. Contemplating the financial which means of regression coefficient, and to be able to improve the smoothness of information, logarithmic processing is carried out on the variables of synthetic intelligence trade index, financial high-quality growth index and technological innovation.

The findings point out that the factitious intelligence trade index, because the core explanatory variable, has a constructive impression on high-quality financial growth and passes the importance take a look at on the 1% stage. Financial growth is a steady technique of gradual transformation.