Breakthroughs in synthetic intelligence (AI) are advancing so instantly, it really is acquiring tougher to think about a globe during which the applied sciences simply is not impacting nearly each aspect of each day life-style.

While a substantial amount of the chatter surrounding AI has revolved near areas this form of as accelerated computing and healthcare, you will discover yet one more use scenario which is piqued my curiosity. Integrating synthetic intelligence into the company workforce signifies a unique and persuasive prolonged-term alternative.

Ark Make investments CEO Cathie Picket has declared that AI software program has the means to considerably enhance effectivity within the place of job. In a brand new report, Picket signifies that AI automation software program program could possibly be a $13 trillion market place in 2030.

Take into account it or not, there are a number of firms specializing in constructing additional profitable place of job environments by the power of expertise. UiPath (NYSE: Route) is a high participant in AI-powered automation assets, and I feel it could possibly be the best monetary funding selection on this pocket of the AI realm.

Allow us to crack down how AI can redefine place of job dynamics and consider why UiPath is a strong very long-expression risk.

Workplace productiveness is ripe for disruption

Bringing efficiencies to easy duties will not be a brand new thought. In fairly a number of circumstances, technological know-how has been the important thing to unlocking these positive factors.

In Ark Make investments’s Enormous Solutions 2024 report, Picket gives some attention-grabbing scenario analysis linked to robotics and the way they’ve elevated finishing mundane and administrative areas of labor.

For illustration, Picket states that the arrival of the washing tools scale back down the standard time to do laundry by 87%. Equally, integrating meeting traces into factories noticeably lowered the time required to fabricate a auto.

These methods have been utilized to the place of job for a few years. For instance, income and selling leaders have relied on client relationship administration (CRM) assets from the likes of Salesforce for a few years.

Moreover, enterprise useful resource planning (ERP) suites from SAP and Oracle have facilitated among the premier firms on the earth in terms of aggregating financials, inspecting functioning metrics, and far more.

In accordance with Picket, by automating duties by synthetic intelligence, the strange employee’s effectivity may increase by 4.5x. If the entire doable software program distributors captured simply 10% of the productiveness get, Wooden posits, these companies may reap $13 trillion in blended income.

This circumstance implies that UiPath has a greenfield probability because it pertains to the intersection of AI and office effectivity. Let’s dive into how the group is mainly performing, and the way it stacks up in the direction of the competitors.

UiPath is main the cost

UiPath operates within the robotic processing automation (RPA) market. Primarily, the agency’s software program will help automate administrative tasks and strengthen workflow processes.

UiPath completed remaining yr with round 2,000 customers expending a minimum of $100,000 per yr on its system. As well as, UiPath larger its shopper depend by 26% 12 months round 12 months for all these expending a minimum of $1 million for each 12 months on its pc software program suite. This highlights UiPath’s deep penetration in every smaller and midsize enterprises (SMEs) as properly as larger company accounts.

The accelerated shopper adoption is not actually solely stunning specified how an amazing deal need for AI has risen above the previous calendar 12 months. The enterprise elevated income by 24% previous 12 months to $1.3 billion. Within the meantime, adjusted free {dollars} circulation was $309 million. By comparability, the agency was basically breakeven on a no cost-cash-movement basis in the course of the prior 12 months.

With an spectacular lover ecosystem that options SAP, IBM, Accenture, PwC, and Deloitte, I feel UiPath’s development story is simply acquiring begun.

A compelling valuation narrative

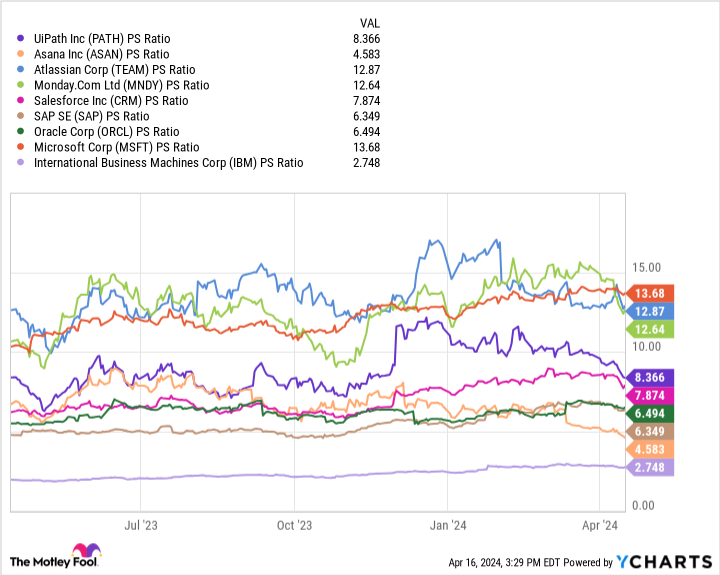

The chart below benchmarks UiPath from a cohort of different firm software program package deal platforms that supply place of job productiveness options. With a promoting price-to-income (P/S) ratio of 8.4, buyers can see that UiPath is positioned appropriate in the course of this peer set.

What I get hold of most fascinating in regards to the evaluation over is that UiPath is valued way more according to the bigger tech behemoths working within the RPA room — with Microsoft getting the lone exception. Offered the nice outcomes Microsoft has proven by way of its CoPilot system, it may be not fully astonishing to see it shopping for and promoting at such a obvious prime quality between this peer established.

Retain in mind that UiPath completed remaining yr with about $2 billion of funds and equivalents on its stability sheet. While the group is cash-move-positive, one explicit product to take a look at is how the enterprise will allocate its belongings. In purchase to compete with important tech behemoths at scale, UiPath will almost certainly must have to extend investing.

Although that will impression the agency’s backside line, it could possibly be a worthwhile strategy. I am optimistic in regards to the efficiencies that AI can present to the office within the intensive run, and am aligned with Wooden’s precept that the market place prospect is big.

So significantly, UiPath has confirmed that it could actually compete within the RPA market from larger and improved-capitalized enterprises. Provided how quickly AI is impacting different important conclude markets, I assume will probably be sooner alternatively than in a while that the technological know-how will begin out to make main impacts on place of job environments.

I really feel now’s a superior time to consider scooping up shares in UiPath as effectivity ends in being further of a focus for companies of all sizes.

Should you spend $1,000 in UiPath right now?

Simply earlier than you put money into inventory in UiPath, ponder this:

The Motley Idiot Inventory Advisor analyst workforce simply acknowledged what they consider which are the 10 best shares for patrons to buy now… and UiPath wasn’t an individual of them. The ten shares that manufactured the reduce may produce monster returns within the coming a very long time.

Take into consideration when Nvidia made this itemizing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $466,882!*

Inventory Advisor gives patrons with an effortless-to-stick to blueprint for fulfillment, resembling steerage on constructing a portfolio, frequent updates from analysts, and two new inventory picks each single month. The Inventory Advisor supplier has way over quadrupled the return of S&P 500 as a result of reality 2002*.

See the ten shares »

*Stock Advisor returns as of April 15, 2024

Adam Spatacco has positions in Microsoft. The Motley Idiot has positions in and suggests Accenture Plc, Asana, Atlassian, Microsoft, Monday.com, Oracle, Salesforce, and UiPath. The Motley Idiot suggests Intercontinental Group Gear and suggests the pursuing options: prolonged January 2025 $290 telephone calls on Accenture Plc, extended January 2026 $395 calls on Microsoft, quick January 2025 $310 telephone calls on Accenture Plc, and restricted January 2026 $405 telephone calls on Microsoft. The Motley Fool has a disclosure protection.

Artificial Intelligence (AI) Effectivity Devices Might Be a $13 Trillion Sector, In accordance with Cathie Picket. Listed right here Is 1 Stock That Might Dominate. was initially launched by The Motley Idiot

Read through additional on GOOLE News