We do the evaluation, you get the alpha!

Get distinctive opinions and procure to important insights on airdrops, NFTs, and further! Subscribe now to Alpha Experiences and up your recreation!

Go to Alpha Opinions

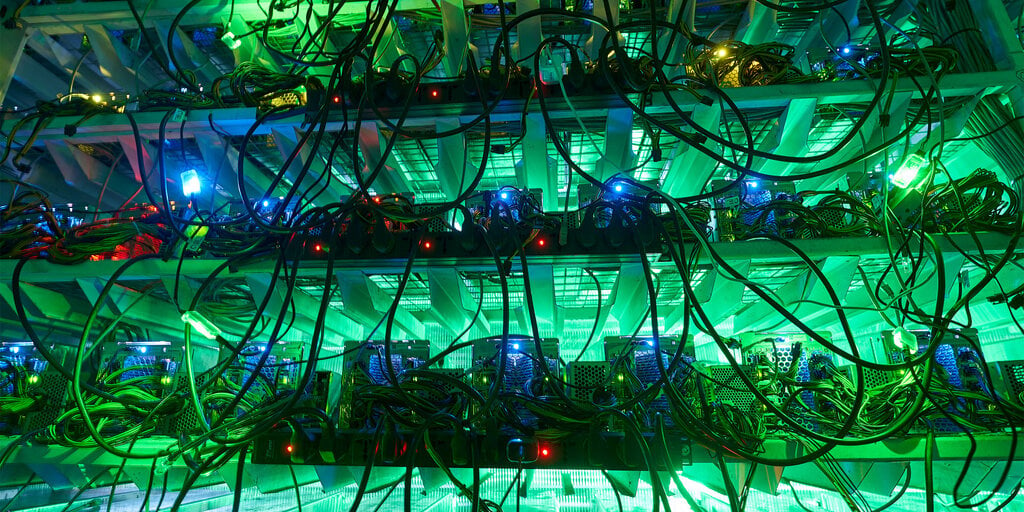

Bitcoin miners are progressively going by off from a brand new foe to deal with ahead of this week’s halving: the AI growth.

Analysts at monetary funding firm AllianceBernstein, Gautam Chhugani and Mahika Sapra, claimed that miners are actually competing with AI information services in areas like Texas.

Bitcoin miners are largely centralized operations that mint new digital money. To take action, a Monday report clarifies, they wish to use quite a lot of laptop methods and consequently electrical energy. Within the meantime, the booming AI area can also be electrical power-hungry. Equally industries glimpse to areas like Texas, which has reasonably priced power and heaps of land to make data services.

At the moment’s report claimed that the rising degree of competitors with the AI market “has constructed land acquisition with energy contracts comparatively aggressive for miners.”

The report additionally additional that the AI hype might probably additionally help miners who’ve spare cash movement, nonetheless.

“Bitcoin ASIC chips have skilled to deal with strong AI chips need this cycle, and due to this fact makers have been eager on bulk contracts/purchase prospects with miners who’re flush with money” from cash raises.

The analysts additional that miners have been at a “relative benefit” with the approaching halving.

Miners are rewarded with Bitcoin for minting new cash however this week’s occasion—which happens each 4 years—will scale back these advantages in 50 % from 6.25 BTC to three.125 BTC. This implies miners have been making able to do the job way more competently to remain within the race.

The Bernstein analysts additionally talked about that CEOs of mining firms have claimed their corporations are in a relatively comfy cash posture ahead of the halving—regardless of Bitcoin’s present price ticket dip.

“The CEOs additionally degree to comparatively very low bank card debt on the equilibrium sheet and even additional no instruments financing pledging mining rigs,” the report extra.

Bitcoin’s worth has dipped nicely beneath its March all-time excessive of roughly $74,000 for every coin. The asset is now shopping for and promoting for $63,145, in response to CoinGecko—beneath its earlier all-time superior of $69,044 it touched in 2021.

Edited by Ryan Ozawa.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25384193/STK470_AI_LAW_CVIRGINIA_C.jpg)