Elevated borrowing prices make long-term investments costlier.

Relying on which headlines you’ve been studying, you may need gotten the sense that each one shouldn’t be effectively with the inexperienced transition. Latest weeks have seen a bevy of dropped tasks and tempered ambitions. Orsted canceled a excessive profile offshore wind mission in New Jersey. One estimate suggests {that a} full 30% of state-contracted offshore wind tasks have been scuttled. GM and Honda nixed a significant partnership to make electrical automobiles, whereas GM dropped its EV manufacturing targets and Ford introduced a significant delay in EV spending. The iShares International Clear Power ETF, a benchmark index of unpolluted vitality shares, was down 30% year-to-date final week, towards a 7% improve within the Dow.

Wind tasks like these are evidently not headed to the Jersey Shore. (Picture supply: NYTimes)

When you click on via and skim these tales, one frequent thread is the position of upper rates of interest. Central banks have been holding rates of interest “increased for longer,” and this alteration in borrowing situations has grow to be an oft-cited motive for inexperienced mission slowdowns. Are right now’s rates of interest an actual roadblock, or only a fast bump within the street?

Why are excessive rates of interest unhealthy for the inexperienced transition?

Greater rates of interest make it costlier to borrow or spend cash right now. Greater borrowing prices make it costlier to put money into fossil fuels in addition to inexperienced applied sciences, however increased borrowing charges current a relative drawback for inexperienced applied sciences for 3 most important causes.

First, inexperienced applied sciences are likely to commerce off increased up entrance prices towards decrease working prices, which signifies that borrowing prices have the next proportional impact on inexperienced investments. That is most acute for photo voltaic and wind, which get free gasoline from nature and thus have complete prices closely skewed towards upfront capital and set up. Pure gasoline vegetation, in distinction, have a extra balanced mixture of prices and are thus much less delicate to a rise in financing charges. The identical precept applies to EVs, which change the next up entrance buy worth for decrease value per mile, as in comparison with gasoline options.

Second, inexperienced applied sciences are inherently about change. Greater borrowing prices sluggish total funding and decelerate churn. When borrowing is difficult, households will maintain onto their present automobiles, air conditioners and furnaces for longer, which slows down the pure turnover that favors cleaner items. On the provision facet, electrification requires huge funding in transmission, and carbon seize calls for brand spanking new pipelines and plenty of capital.

Third, extra nascent inexperienced applied sciences–assume storage, direct air seize and electrolysis–nonetheless want a heavy dose of pure analysis and growth. R&D prices extra when cash is pricey, so a world with increased rates of interest favors incumbents.

How a lot have rates of interest modified, and is that this sufficient to matter?

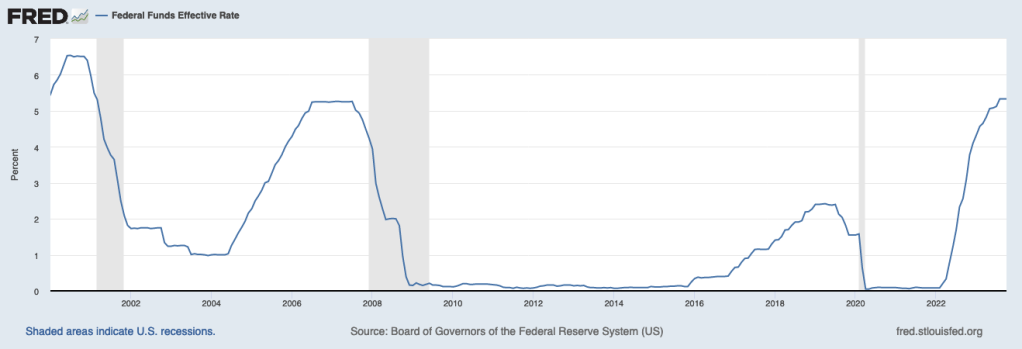

Essentially the most salient benchmark rate of interest within the US is the Federal Funds Fee, which governs interbank lending and which the Federal Reserve Board instantly controls. The efficient Fed Funds Fee at the moment sits at 5.25%, a 22-year excessive. The Federal Funds Fee spent a lot of the final dozen years at a pleasant cozy 0%, and we’ve got to rewind to the Bush Administration to search out charges increased than we’ve got right now.

The Efficient Federal Funds Fee is at a 22-year Excessive (Supply: St. Louis Federal Reserve)

Estimates from the IEA counsel {that a} 5% improve within the borrowing prices utilized to a mission raises the levelized value of wind or photo voltaic by as a lot as 50%, whereas having a single digit affect on a brand new gasoline plant.

And, in case you missed it, the price of renewables has risen since 2020. The preliminary shock was as a consequence of commodity worth spikes, which have since stabilized, however elevated financing prices imply that the IEA tasks that the levelized value of photo voltaic and wind in 2024 will stay increased than their pre-pandemic benchmark.

Alternatively, issues will not be that unhealthy

A 5 % swing in rates of interest is a giant deal for borrowing. However, the Federal Funds Fee is a nominal charge, a charge that doesn’t regulate for inflation. We’ve got excessive rates of interest partly as a result of we’re reckoning with inflation, and economists usually assume the factor that issues most for funding is the actual rate of interest, which adjusts for inflation. The change in borrowing prices seems to be much less dramatic when one adjusts for inflation. The ten-year actual rate of interest on US Treasuries calculated by the Federal Reserve, which tasks inflation primarily based on a set of forecasts, reveals one thing nearer to a 2% improve over the past couple of years.

Actual Curiosity Charges are Elevated, however Far Lower than the Nominal Fee (Supply: St. Louis Federal Reserve)

A 2% improve is nothing to sneeze at, however typical estimates present that, even with elevated financing prices, renewables stay the most cost effective supply of energy. Modest strikes within the rate of interest will push marginal tasks out of the cash and decelerate renewable deployment, but it surely received’t flip the large image. So, think about this a notable headwind, however not an existential menace.

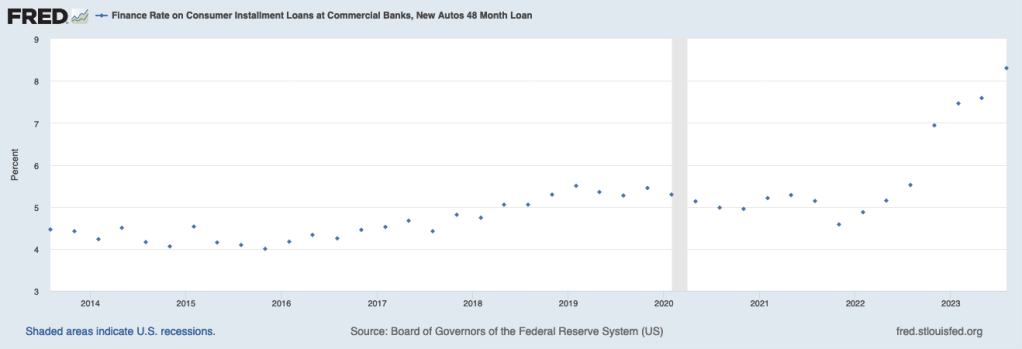

Whereas economists argue that the inflation-adjusted actual rate of interest is probably the most related for determination making, it might be that households are delicate to nominal charges that have an effect on their notion of borrowing prices. The Fed collects knowledge on the rate of interest on automobile loans, which reveals that the typical charge for brand spanking new automobile loans has just lately jumped above 8%.

Nominal Charges on Automobile Loans have Jumped, Making EVs a Extra Costly Choice (Supply: St. Louis Federal Reserve)

Typical knowledge means that automobile patrons deal with month-to-month funds. The typical EV prices greater than $50,000. If a automobile purchaser financed your entire quantity with a four-year mortgage, a bounce from 4% to eight% within the mortgage charge would improve the month-to-month fee by about $90. That is greater than the drop in month-to-month funds as a result of $7,500 federal EV tax credit score, which might knock down the month-to-month fee in the identical state of affairs by round $80.

However, most patrons received’t finance your entire quantity, and better rates of interest increase the month-to-month fee of inner combustion engine automobiles as effectively, that are promoting for less than about $5,000 much less on common. For a client selecting between an EV and a traditional automobile, if the EV worth premium had been $10,000, the bounce from 4% to eight% on a 48 month mortgage solely adjustments the relative fee by about $20 a month. This may nonetheless matter for some automobile patrons, however my suspicion is that increased borrowing prices will principally affect EV purchases by miserable total new automobile gross sales, as patrons maintain onto present vehicles longer, slightly than inflicting them to decide on a brand new typical automobile as an alternative of a brand new EV.

Trying forward

Final yr, Reuters surveyed a bunch of economists, they usually agreed that increased rates of interest had been of gentle concern for the inexperienced transition. I are likely to agree–whether or not actual rates of interest are 0% or 2% or 3%, the inexperienced transition within the US is more likely to march alongside, although there shall be some decelerate on the margin.

Latest information from probably the most hawkish Fed governors suggests the present charge “pause” could also be prolonged. We could already be peak charges. So, we must always maintain our eye on these macro elements, however the greater subject with financing and the inexperienced transition might be about guaranteeing entry to capital in lower-income nations, not worrying concerning the Federal Funds Fee within the US.

This view, nevertheless, hinges critically on the presumption that coverage help from the IRA and associated mechanisms stays sturdy. And excessive rates of interest could but have a job to play on this regard.

Most provisions of the 2017 Tax Cuts and Jobs Act expire in 2025, which signifies that after subsequent yr’s election, Washington will nearly definitely need to reckon with tax coverage. This fiscal debate will occur within the shadow of a quickly rising nationwide debt, fueled by each current spending (together with the IRA) and rising debt financing prices as a consequence of increased rates of interest. Latest estimates from the Congressional Funds Workplace projected that the annual value of financing the nationwide debt would exceed $600 billion in 2023 and complete $10 trillion within the subsequent decade. The federal debt takes on a totally totally different dynamic at increased rates of interest, and these budgetary pressures might rapidly rise in significance, as argued right here.

How may this affect environmental coverage within the 119th Congress? In a single (wildly?) optimistic state of affairs, a necessity for income might reignite curiosity in pricing carbon. Alternatively, the next debt load provides a motive (or a pretense) for gutting the aggressive inexperienced subsidies handed by the Biden Administration. In a twist of irony, to get decrease charges and thus ease debt financing prices, we may have a good bit of inflation discount in an effort to save the Inflation Discount Act.

In fact, which path we take relies upon most significantly on who sits within the White Home and who controls Congress in 2025. Thus, if excessive rates of interest right now affect the electoral consequence itself–both by taming inflation or by fueling perceptions of a poor financial system–that might be probably the most important means by which the Fed’s choices on charge’s right now have an effect on the inexperienced transition of tomorrow.

Steered quotation: Sallee, James. “Do Excessive Curiosity Charges Threaten the Inexperienced Transition?”